The world of cryptocurrency is showing promising signs of a potential bull market comeback, with key indicators pointing towards a significant decrease in bearish pressure.

A crucial metric to monitor in this context is the 30-day Moving Average (30DMA) Net Taker Volume, which has plummeted from $15 million over 30 days to just $1.8 million over the same period. This sharp decline represents the most significant reduction in bearish pressure seen in the past two years.

Bitcoin expert Axel Adler Jr, a verified author on CryptoQuant, has noted that this decrease in bearish pressure could serve as the final signal for the start of a new rally in the cryptocurrency market. The drop in the 30DMA Net Taker Volume suggests that sellers are losing their grip, potentially paving the way for a shift in sentiment towards positivity.

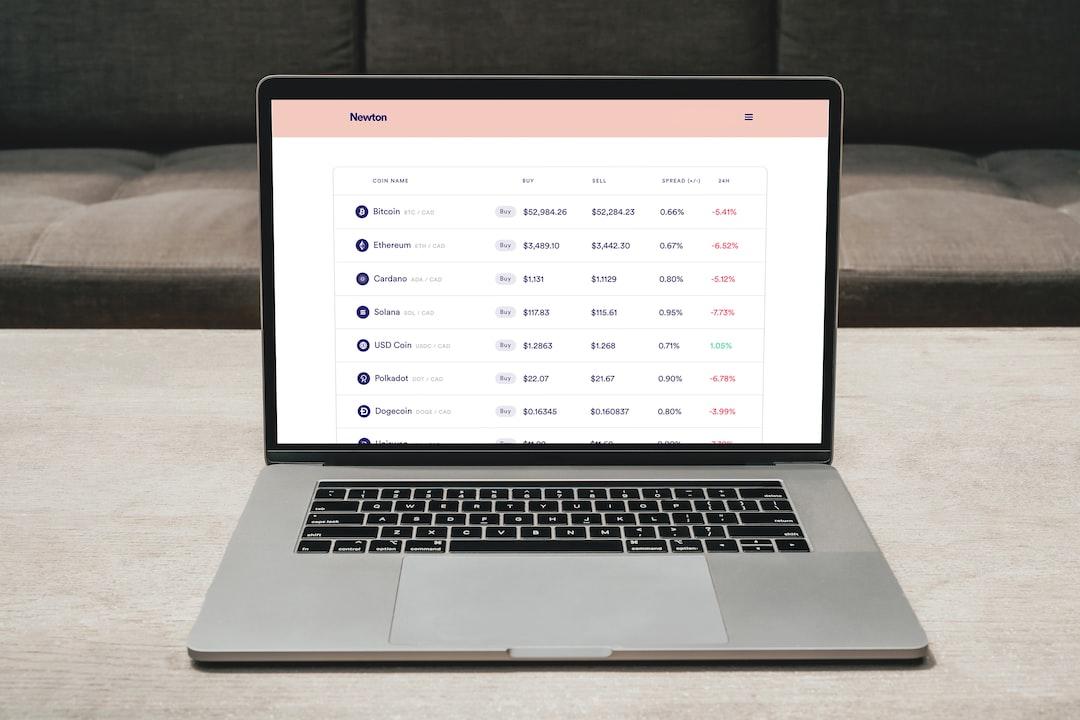

Another indicator of a bullish shift can be observed in the reduced trading volume on Coinbase, which currently accounts for 46% of all spot trading. The average daily trade volume on Coinbase has dwindled from 25,000 BTC per day to 9,700 BTC per day. In a bull market scenario, this decline in trading volume signifies a lack of strong selling pressure, as indicated by the yellow bars on the trading charts.

This decrease in selling pressure could lead to higher prices due to increased buyer demand in the market. Ultimately, this trend could result in a decrease in selling patterns within the cryptocurrency market, signaling the beginning of a bull market. This creates a favorable environment for trading and investing in cryptocurrencies.